How PSD Bank Nürnberg Successfully Uses AI with Lime Connect

Many banks are still hesitant, but financial institutions like PSD Bank Nürnberg are already reaping the benefits of AI support. Nearly 70% of customer inquiries are now handled automatically by a chatbot.

PSD Bank Nürnberg is a cooperative retail bank with eight locations throughout Franconia, the Upper Palatinate, and Saxony. Around 150,000 customers rely on this long-standing financial institution for traditional banking services, including current accounts, loans, and investment products.

As is now standard in e-commerce, consumers increasingly expect banks to offer seamless online financial management — ideally, around the clock.

Customers today expect consistent, time- and location-independent support. For us, this is essential if we want to match the service standards of direct banks and other financial institutions.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

Leader in Digital Transformation

While other banks try to solve the challenge of rising customer expectations and service costs through mergers, PSD Bank Nürnberg adopted a different approach from the outset, focusing on expanding its digital customer communication channels. One of the most important steps was introducing a website chat and WhatsApp as modern support channels.

Although the channels were well received, Jochen Hofmann, PSD Bank Nürnberg’s Senior Online Marketing Manager, noticed that support via the two new chat channels was not yet working optimally.

Especially in the evening hours, when customers want to find out about financial products or make transfers, neither the live chat on the website nor the WhatsApp support were available.

Another problem was that the two channels were operated separately, so employees had to switch between different applications. Additionally, the support team frequently received the same requests.

Nobody in customer service wants to solve the same problem several times a day, especially in stressful situations such as product changeovers or staff shortages. Furthermore, it was not possible to do so outside of business hours.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

Making service more efficient with German chat software

The goal was to partially automate support to provide evening and weekend availability and to reduce employee workload during service hours.

The new software would also enable PSD Bank Nürnberg to process inquiries from both messaging channels in one inbox. “Our customer service colleagues had explicitly asked us for a more comprehensive platform because neither channel could be used on one platform at the time,” says Hofmann.

As a financial institution, PSD Bank Nürnberg has numerous security mechanisms in place, especially regarding data protection when introducing new software. Therefore, when choosing a solution, it was important to the marketing manager that customer communication via WhatsApp and website chat be GDPR-compliant.

After researching the German market, the bank quickly chose Lime Connect. The unified messaging solution, which offers data protection security, was convincing due to its central inbox for website chat and WhatsApp. The tool also met the exact requirements on the employees’ wish list: These include chat forwarding, chatbot automation, and a live chat that allows conversations to continue asynchronously after hours or days on the website.

Thanks to Lime Connect, we can map all processes within one system, eliminating the need for multiple logins. User management is standardized, as is the addition and deletion of individual operators. With WhatsApp and the seamless continuation of chats, we can now work asynchronously and are no longer reliant on an immediate response.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

Implementing the new software went smoothly. Within a few days, all employees had become familiar with it.

Working faster through automation with AI

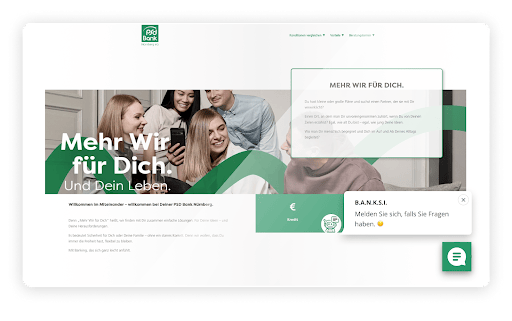

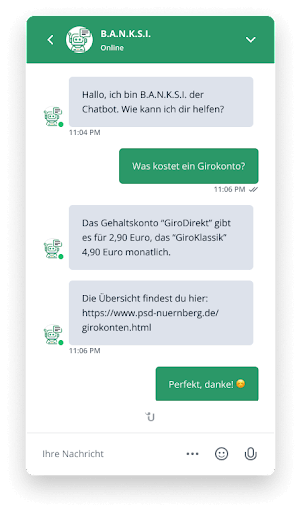

In addition to website chat and WhatsApp, the company introduced a rule-based support chatbot. B.A.N.K.S.I. handled frequent requests and only transferred chats to the service team when it could not solve them.

However, maintaining and expanding the chatbot’s knowledge base still required manual work. Therefore, PSD Bank Nürnberg decided to connect its chatbot to Lime Connect’s AI solution. This transformed the simple logic bot into an AI chatbot that can answer queries more specifically and learn from every customer interaction.

.

I set up, tested, and implemented Lime Connects AI solution in three days. This was followed by a one-week live testing period. Since we already had a logic bot, the question catalog could be migrated quickly and easily. The new solution also makes handling easier, so there is no need for further programming of the bot. This accelerated the implementation process.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

Since then, customers have been able to contact their bank 24/7 and receive support directly from chatbot B.A.N.K.S.I. “The bot currently handles 85-90% of inquiries, which means our service employees only assist with complicated cases or upon request,” reports Jochen Hofmann.

The knowledge database can easily be expanded at any time and quickly provides relief, even with high volumes of inquiries. PSD Bank Nürnberg benefited from this during the current account changeover in spring 2023, for example, when the chatbot handled a large proportion of customer queries.

Hofmann is also proud of B.A.N.K.S.I.’s sales capabilities. Although the AI agent is primarily used for customer service, it has already helped to open a current account, thereby improving the bank’s conversion rate.

The bot directly answers around 70 percent of inquiries and is involved in 85 to 90 percent of them. This is particularly important to us because it allows us to respond to inquiries received on weekends or public holidays, even though we don’t have an employee staffing the chat on those days.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

The Digital Manager and his team are happier since using the AI bot, and so are PSD Bank customers. Thanks to its connection to the intelligent knowledge database, B.A.N.K.S.I can answer customers’ questions much more specifically.

Hofmann can view customer satisfaction directly in the Lime Connect dashboard, where feedback, service ratings and the conversation itself are stored. This allows the bank to optimize the chatbot at any time if necessary.

Don’t be afraid of new technologies! Lime Connects AI is a solution that doesn’t require any programming skills. I was actually surprised at how easy many of the functions were to use. Of course, our bot doesn’t replace employees; however, it does help relieve their workload, especially during periods of high demand.

Jochen Hofmann

Senior Online Marketing Manager

PSD Bank Nürnberg

Let’s connect

Are you interested in using AI automation and messaging? Then, try Lime Connect free for 14 days, or contact us to speak with one of our experts about AI support.